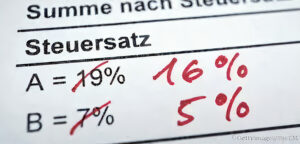

Recognize value added tax risks

Do you know the risks of value added tax (VAT)? Although many entrepreneurs deal with the topic of VAT, risks are often not perceived or perceived late. When it comes to VAT, even small details can turn into a big problem and accordingly cause a big burden for your business. Read here how you can minimize these risks with VAT.

Cross-border restructuring

The legal field around restructurings and conversion of companies is complex, especially because due to the aspect that corporate and tax law have to be harmonized for a successful restructuring. In the following article, you will learn what needs to be taken into account, especially in cross-border restructurings, and how we can support you in this process. The present article deals with restructurings between Switzerland and Liechtenstein. Information on other countries will be provided on an individual basis.

What to consider on VAT and COVID-19 measures?

The current situation due to the extraordinary COVID-19 measures may also have an impact on your value added tax (VAT) accounting. Below you will find an overview with the aspects to be considered.

Important tax questions related to COVID19 – focus on Liechtenstein

The current situation due to the extraordinary COVID measures may also have an impact on the tax situation of employees. One year after the start of the COVID-19 pandemic and in view of the submission of the tax returns for the years 2020 and 2021, significant questions are increasingly arising regarding the imputation / deduction of individual costs. Below you will find an overview with current information that may also affect your tax return.

Important tax questions related with COVID 19 – focus Switzerland

The current situation due to the extraordinary COVID measures may also have an impact on the tax situation of employees. One year after the start of the COVID-19 pandemic and in view of the submission of the tax returns for the years 2020 and 2021, significant questions are increasingly arising regarding the imputation / deduction of individual costs. Below you will find an overview with current information that may also affect your tax return.

Anti-abuse provisions

Review your portfolio and act before December 31, 2021 to avoid further document expense and an additional 12.5% tax.

Employees as cross-border commuters: Part 1

Due to their geographical location, companies have to deal with the cross-border commuter issue. What to do when your employees cross borders. Get an insight into current tax and social security aspects for cross-border commuters. In this article you will get a general overview of tax liability in Switzerland.

Employees as cross-border commuters: Part 2

Many companies in the Principality of Liechtenstein and the Rhine Valley, Sarganserland region have to deal with the cross-border commuter issue due to their geographical location. What to do when their employees cross borders. Get an insight into current tax and social security aspects for cross-border commuters. In this article you will get a general overview of the double taxation agreements (DTA) between Germany, Liechtenstein and Switzerland.

Adjustments MWSTG for company vehicles

On November 2, 2021, the Swiss Federal Tax Administration (FTA) published a draft of the practice determination in which the approach for the lump-sum calculation of private share on business vehicles is to be increased from 0.8% to 0.9% of the purchase price, also for VAT purposes. The adjustment is to take place as early as 01.01.2022.