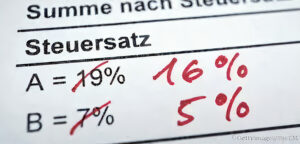

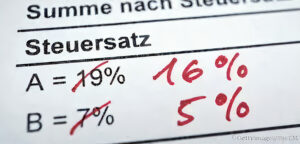

What to consider on VAT and COVID-19 measures?

The current situation due to the extraordinary COVID-19 measures may also have an impact on your value added tax (VAT) accounting. Below you will find an overview with the aspects to be considered.

The current situation due to the extraordinary COVID-19 measures may also have an impact on your value added tax (VAT) accounting. Below you will find an overview with the aspects to be considered.

The current situation due to the extraordinary COVID measures may also have an impact on the tax situation of employees. One year after the start of the COVID-19 pandemic and in view of the submission of the tax returns for the years 2020 and 2021, significant questions are increasingly arising regarding the imputation / deduction of individual costs. Below you will find an overview with current information that may also affect your tax return.

The current situation due to the extraordinary COVID measures may also have an impact on the tax situation of employees. One year after the start of the COVID-19 pandemic and in view of the submission of the tax returns for the years 2020 and 2021, significant questions are increasingly arising regarding the imputation / deduction of individual costs. Below you will find an overview with current information that may also affect your tax return.

Unfortunately, the Corona pandemic continues to be omnipresent. Therefore, intergovernmental regulations have been extended again. This has an impact on the tax area also the social security regulations.