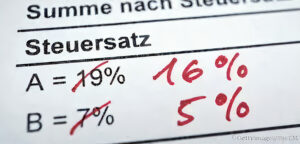

Recognize value added tax risks

Do you know the risks of value added tax (VAT)? Although many entrepreneurs deal with the topic of VAT, risks are often not perceived or perceived late. When it comes to VAT, even small details can turn into a big problem and accordingly cause a big burden for your business. Read here how you can minimize these risks with VAT.